Cash may be used to pay off debt, so a negative cash flow may decrease liabilities. Cash may be used to purchase assets, so a negative cash flow may increase assets.

To make sound financial decisions, you need to be able to foresee the consequences of a decision, to understand how a decision may affect the different aspects of the bigger picture.įor example, what happens in the income statement and cash flow statements is reflected on the balance sheet because the earnings and expenses and the other cash flows affect the asset values, and the values of debts, and thus the net worth. Each is a piece of a larger picture, and as important as it is to see each piece, it is also important to see that larger picture. (that it takes some money to make money see Chapter 2 “Basic Ideas of Finance”).Ĭommon-size statements put the details of the financial statements in clear relief relative to a common factor for each statement, but each financial statement is also related to the others. Alice has run head first into Adam Smith’s “great difficulty” Adam Smith, The Wealth of Nations (New York: The Modern Library, 2000), Book I, Chapter ix. In order to create investment income, however, she needs to have a surplus of liquidity, or cash, to invest. She could diversify by adding earned income-taking on a second job, for example-or by creating investment income. Because her positive net earnings and positive net cash flows depend on this one source, she is exposed to risk, which she could decrease by diversifying her sources of income. Likewise, both her income and her positive cash flows come from only one source, her paycheck. Her asset value would be less exposed to risk if she had asset value from other assets to diversify the value invested in her car. If something happened to her car, her assets would lose 95 percent of their value. Diversification reduces risk, so you want to diversify the sources of income and assets you can use to create value ( Figure 3.17 “Pie Chart of Alice’s Common-Size Balance Sheet: The Assets”).įigure 3.17 Pie Chart of Alice’s Common-Size Balance Sheet: The Assetsįor example, Alice has only two assets, and one-her car-provides 95 percent of her assets’ value. The common-size analysis is also useful for comparing the diversification of items on the financial statement-the diversification of incomes on the income statement, cash flows on the cash flow statement, and assets and liabilities on the balance sheet. The relative size of the items helps you spot anything that seems disproportionately large or small. For example, it is immediately obvious that Alice’s student loan dwarfs her assets’ value and creates her negative net worth.Ĭommon-size statements allow you to look at the size of each item relative to a common denominator: total income on the income statement, total positive cash flow on the cash flow statement, or total assets on the balance sheet. This common-size balance sheet allows “over-sized” items to be more obvious.

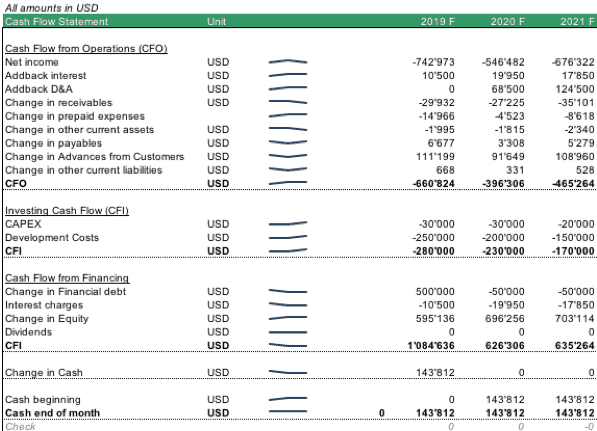

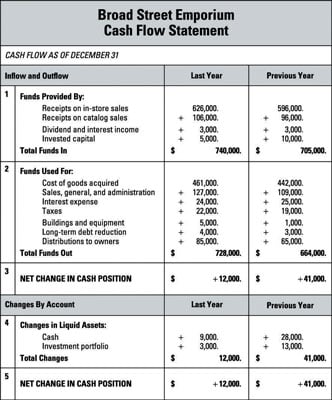

This is the purpose of financial statement analysis: creating comparisons and contexts to gain a better understanding of the financial picture.įigure 3.16 Alice’s Common-Size Balance Sheet, December 31, 2009 Since the three statements offer three different kinds of information, sometimes it is useful to look at each in the context of the others, and to look at specific items in the larger context. The three provide a summary of earning and expenses, of cash flows, and of assets and debts. Each one-the income statement, cash flow statement, and balance sheet-conveys a different aspect of the financial picture put together, the picture is pretty complete. Describe the uses of comparing financial statements over time.įinancial statements are valuable summaries of financial activities because they can organize information and make it easier and clearer to see and therefore to understand.Identify the purposes and uses of ratio analysis.

0 kommentar(er)

0 kommentar(er)